option to tax form

Use this form only to notify your decision to opt to tax land andor buildings. Select the document you want to sign and click Upload.

Tips For Buying Tax Exempt Textbooks Textbook Tips Tax

A typed drawn or uploaded.

. In this case please send both forms to the appropriate VAT Registration Unit VRU. The underlying principle behind the taxation of stock options is that if you receive income you will pay tax. 60 of the gain or loss is taxed at the long-term capital tax rates.

If you have a limited liability company known as an LLC you have options in how you could be taxed. Once youve made a real estate election you cannot revoke it. The taxation of options contracts on exchange traded funds ETF that hold section 1256 assets is not always clear.

Where do I send this form. If you must file you have two options. Filing an electronic tax return often called electronic filing or e-filing or.

According to the IRS the fastest and easiest option to file a tax extension is to submit Form 4868 using the IRS Free File serviceForm 4868 is a simple one-page form that asks for your name. Consult with a tax professional if. In the future individuals or Hindu undivided families will be able to include details.

Choosing the right tax status for your small business is important. Form Disapply the option to tax land sold to housing associations. Filing a paper tax return.

10 June 2022 Form Revoke an option to tax after 20. Send this form to. It would mean being able to reclaim all the value added tax VAT on the purchase of the property and land as well as any professional costs and ongoing expenses.

Notification of the exclusion of a new building from the effect of an option to tax for the purpose of paragraph 27 of Schedule 10 to the VAT Act 1994 must be made on form VAT1614F and must. Important complete this form only to notify a real estate election. Email HMRC to ask for this form in Welsh Cymraeg.

VAT 1614A Opting to tax land and buildings Notification of an option to tax Subject. Use this form if you want to revoke an option to tax land or buildings where more than 20 years have passed since the option took effect. Section 1256 options are always taxed as follows.

Get Access to an Online Library of 85k Forms Packages that You Can Edit eSign Online. Form it is strongly recommended that you read Notice 742A Opting to tax land and buildings available from our website go to wwwhmrcgovuk A paper copy and general guidance are available from our advice service on 0845 010 9000. Currently when a customer notifies of an intention to Opt to Tax a property through a VAT 1614A form we acknowledge the notification and carry out an extensive series of checks on the notification itself.

Form 10 Income Tax. Pick the document template you will need from our collection of legal form samples. Please complete this form in black ink and use capital letters.

Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need. US Legal Forms ensures you locate an up-to-date and professionally checked legal template that fully meets your needs and states regulations. 0 Fed 1499 State.

Complete the required boxes these are yellow-colored. Execute OPTION TO TAX LAND ANDOR BUILDINGS NOTIFICATION FORM within a couple of clicks following the recommendations listed below. Each year most people who work are required to file a federal income tax return.

This type of transaction can prove complicated however and will. So in order to claim input tax on the cost of buying and improving the property our landlord must opt to tax it and be VAT-registered so that his rental income is standard-rated taxable rather than exempt. Find Industry-specific Forms Now.

Print it after downloading or fill it out online. 8 October 2014 Form Apply for permission to opt to tax land or buildings. 40 of the gain or loss is taxed at the short-term capital tax rates.

Send the completed form and supporting documents. Option Lease Own Purchase Withholding Tax. Among the new rules of Income-tax 22nd Amendment Rules 2020 that were released by the CBDT on October 01 2020 there is a new Rule 21AG in which a taxpayer may exercise his option under section 115 BAC if the option is exercised.

Section 424 of VAT Notice 742A states that HMRC will normally acknowledge receipt of your notification although this is not. It can provide tax savings or it can cost you money. Entity Classification Election is what you file to change the tax.

E-filing is generally considered safer faster and more convenient but some people cant e-file and must mail. HM Revenue Customs Option to Tax National Unit Cotton House 7 Cochrane Street Glasgow G1 1GY Phone 0141 285 4174 4175 Fax 0141 285 4423 4454 Unless you are registering for VAT and also want to opt to tax. Open market stock options.

There are two main types of stock options. Decide on what kind of signature to create. The relevant form to send to HMRCs Option to Tax Unit in Glasgow is VAT1614A which means that the landlord does not need HMRCs.

Once you understand your options and have decided to make a change Form 8832. Follow the step-by-step instructions below to design youre vat5l form. Beforeyou complete this form we recommendthat you read VATNotice 742A Opting to tax land and buildings goto.

Oil Gas and Minerals. Forms 1010 Features Set 1010 Ease of Use 1010 Customer Service 1010. Ad Sign Fill Out Legal Forms Online on Any Device.

Click the Get form key to open the document and begin editing. There are three variants. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on.

Ad We Support All the Common Tax Forms and Most of the Less-Used Forms. Whether that income is considered a capital gain or ordinary income can affect how much tax you owe when you exercise your stock options. Compare Tax Preparation Prices and Choose the Best Local Tax Accountants For Your Job.

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Small Business Tax Tax Prep

Blue Summit Supplies Tax Forms W2 6 Part Tax Forms Bundle With Software And Self Seal Envelopes 50 Count In 2022 Small Business Accounting Software Business Accounting Software Tax Forms

Irs Response Letter Demozaiektuin Within Irs Response Letter Template 10 Professional Templates Ideas 1 Letter Templates Lettering Letter Writing Template

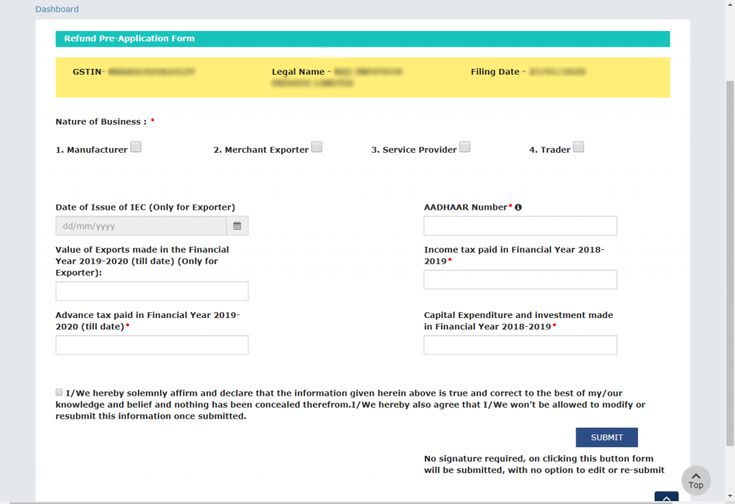

Gst Portal New Feature On Pre Fill An Application Form For Refund Tax Refund Application Form Filing Taxes

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business

Pin By Tarah Rasey On Pta Donation Letter Pto Fundraiser School Pto

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 25 Count Tax Forms Security Envelopes Small Business Accounting Software

Philadelphia Taxes Filing Taxes Tax Forms Tax Advisor

Ip Pin Update For Taxpayers And Tax Professionals Pin Tool Tax Pin

Tax Due Dates Stock Exchange Due Date Tax

Editable Option To Purchase Real Estate Contract Real Estate Etsy

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

General Form Option To Purchase Real Estate Real Estate Forms Legal Forms Real Estate Contract

You Can File Your Tax Return On Your Own It S Easy Quick And Free When You File With Tax2win On Your Onenote Template Income Tax Preparation Tax Preparation

What Are Your Options When It Comes To Filing Your Singapore Company Tax Returns Understand The Difference Between The Two O Tax Return Singapore Filing Taxes

Collective Tax Prep Checklist Tax Prep Health Savings Account

General Form Option To Purchase Real Estate Real Estate Forms Legal Forms Real Estate Contract